Save Operations

High risk of operation when Agents move with cash. Agents being robbed in field.

A solution to Saccos, Money Lenders, Microfinance institutions, and all their branches.

Start Your Free Trial

Digitally transform your business, while improving the quality and convenience of services.

High risk of operation when Agents move with cash. Agents being robbed in field.

Unsecured loans and Poor loan recovery channels

Poor Record Keeping, Huge number of members making it hard to manage their records.

Poor Service Quality, Inadequate education and training.

Limited Capital and Limited Product plus Services offered.

Inadequate KYC and Reconciliation problems. - Due to shortage from Agents and cashiers.

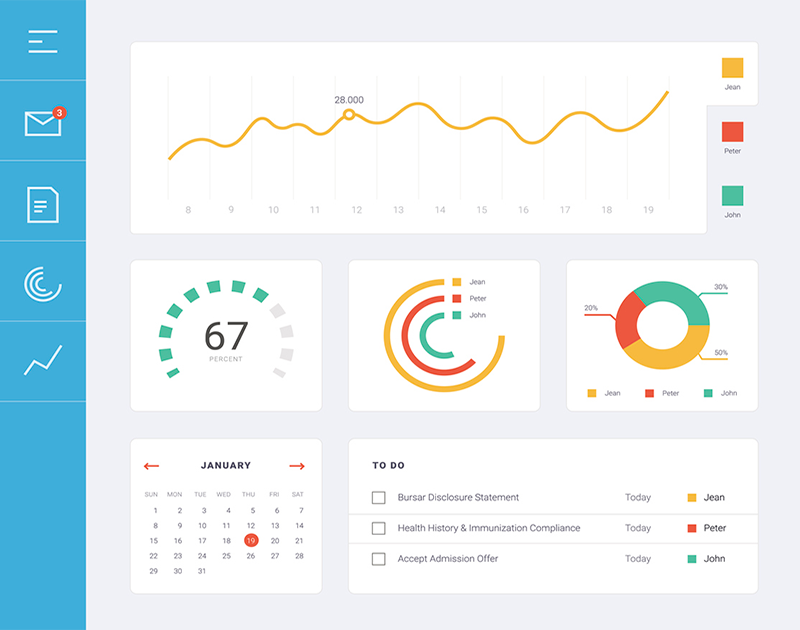

Manage sacco processes and be ready to address any challenge with total ease.

Users can easily register and learn how to use the system faster and with ease.

Analyze customers by region, discounts and more and put a plan in place to improve subscriber retention.

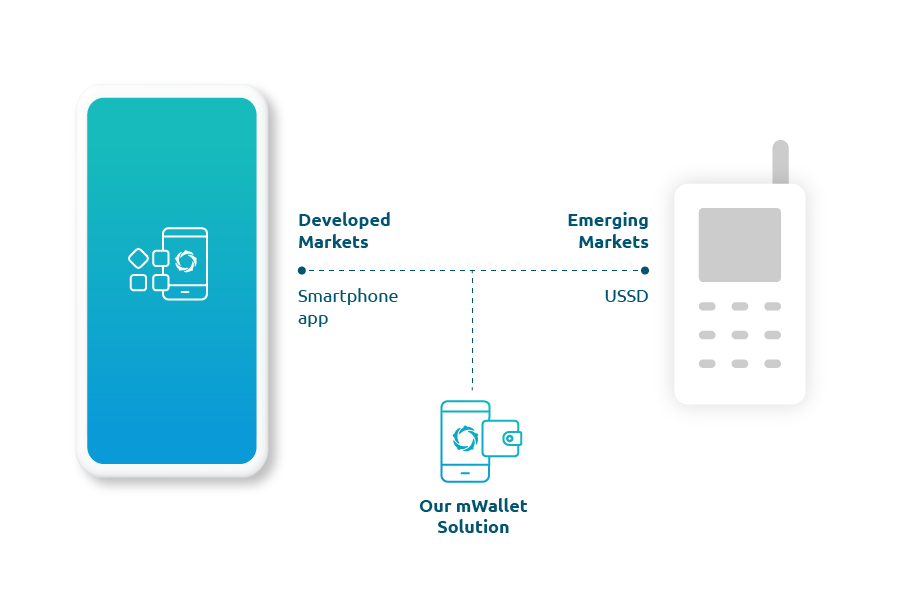

Extend financial services to the bottom of the pyramid at a low cost (for both USSD and smart devices).

Oriems Sacco ERP Mobile Wallet Solution helps microfinance institutions utilize the opportunity of a digital self-service channel, retaining and growing their customer base. An extremely flexible platform which can serve various digital wallet business cases.

Respond to ever-changing customer needs and stay ahead of the competition.

Leverage configurable building blocks, such as self-onboarding, loan origination, and more.

Exceed expectations with compelling digital financial journeys across channels.

Modernize legacy architecture, connecting everything. Unify customer data across silos. Reduce TCO.

Scale the platform gradually thanks to microservices, APIs and reusable modules.

We offer dependable, on-demand support options including 24/7 technical and remote support.

Understand customer behavior across channels, optimize team and agent network performance.

Ntinda Complex, Ntinda

P.O.

Box 21841, Kampala, Uganda

info@intersolve.com,

James.wampamba@intersolve.co.ke

+256 757 535 921

+256 777 133 896